Stock market news: Domestic benchmark indices Nifty 50 and Sensex opened lower on Friday after opening lower on weak earnings and concerns over foreign investment. At the same time, information technology stocks bucked the trend and rose in anticipation of the Federal Reserve’s decision to cut interest rates.

In early trade on Friday, the Sensex fell 424.42 points to 79,117.37 points; the Nifty 50 index fell 132.7 points to 24,066.65 points.

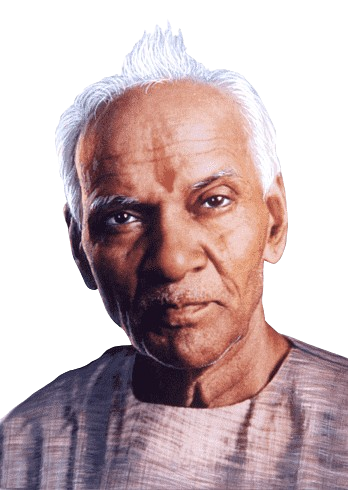

Dr. VK Vijayakumar, chief investment strategist at Geojit Financial Services, pointed out that there are currently two distinct trends in the market: one is the strong performance of the global market, especially the US market, and the other is the decline of the Indian market.

The record-breaking rally in U.S. markets is now driven by “Trump trade,” along with expectations of promised corporate tax cuts and their beneficial impact on U.S. corporate earnings.

Much of the downturn in Indian markets has to do with continued selling pressure from foreign institutional investors (FIIs), which has persisted this month as well. After sharp sell-off by FIIs $FIIs have disinvested Rs 113,858 crore till November $The spot market has Rs 16,445 crore.

Stock Market Tips and Nifty 50 Outlook By Rajesh Palviya, Senior Vice President, Technology and Derivatives Research, Axis Securities

The benchmark index has been consolidating within the 24,600-23,800 level over the past few weeks, indicating a short-term pause and lack of strength in both directions. Therefore, a breakout to either side of this range could signal further direction. The index currently faces a significant resistance zone created by the 20-day and 100-day simple moving averages (SMA), which remains a key hurdle. On the daily chart, the index is trending downward, forming lower peaks and troughs, reflecting a negative bias. Any sustained move above 24,600 levels could lead to a rebound towards 24,800-25,000 levels.

The stock has decisively broken through the “multiple resistance zones” that have closed between 1200-1220 points for the past four years, showing a strong breakout. The breakout was accompanied by huge volume, showing increased participation in the rally. The stock is trading well above the 20-day, 50-day, 100-day, and 200-day simple moving averages (SMA), which have also risen alongside the price, reinforcing the bullish trend. Daily and weekly Bollinger Bands buy signals show increased participation. Additionally, the daily, weekly, and monthly relative strength index (RSI) are all positive, proving the strength of the advance.

Investors should buy, hold and accumulate this stock with expected upside of $1,450-1,713, the downward support area is $Level 1,185-1,125.

On the daily and weekly time frames, the stock continued to move higher, forming a series of higher tops and bottoms, signaling a trend reversal. This buying movement was observed from the 30-week SMA support zone at 1049. It also decisively broke above the three-month downtrend line at the 1175 level. A significant increase in transaction volume means an increase in participation. The daily, weekly and monthly strength indicator RSI is positive, which proves the strength of the advance.

Investors should buy, hold and accumulate this stock with expected upside of $1,385-1,585, the downward support area is $Level 1,180-1,135.

The stock is experiencing a strong uptrend, forming a series of higher tops and bottoms, which suggests the stock is continuing to rise. Recently, the stock decisively broke through multiple resistance levels of 750 points, indicating a positive outlook. It is currently well above the 20, 50, 100 and 200-day simple moving averages (SMA), which are also trending upward as the price rises. This reinforces the bullish trend. Additionally, an increase in trading volumes over the past week points to increased market participation.

Investors should buy, hold and accumulate this stock with expected upside of $835-930, the downward support area is $Level 750-720.

Disclaimer: The above views and recommendations only represent the views and recommendations of individual analysts, experts and brokerage firms, and do not represent Mint. Investors are advised to consult a certified expert before making any investment decisions.

Catch all business news, market news, breaking news events and latest news updates on Live Mint. Download The Mint News app for daily market updates.

moreless