To achieve this, the company aims to grow volume, sales and profitability by at least 25-30% annually, Ajmera added. While he didn’t specify a timeline, he said it could be more than five years.

The real estate agent’s current m-cap is $4015.61 Crore (approximately USD 472 million).

The family-run real estate company plans to invest $Internal cash accruals through acquisitions, joint ventures, joint development agreements (JDAs) and social redevelopment opportunities will be Rs 2,300 crore over the next three to four years.

Ajmera said that through these projects, the company expects to monetize its 11.1 million sq ft land bank in Mumbai and acquire more land in other locations. Mint.

“We’re definitely looking at a $5 billion capital cap,” he said.

Ajmera noted that the company has three generations working and has the ability to oversee seven to 10 projects at a time.

In 2021, the company plans to increase pre-sales $25-300 crore, an increase of 5 times. The company targets pre-sale value $1,350 crore in 2024-25. If achieved, the real estate agent will complete its five-year target in four years.

To be sure, Ajmera’s 25-30% growth target isn’t far-fetched based on its recent financial figures. For the fiscal year ending March 31, 2024, its net sales soared 35% to $4.89 billion, net profit increased by 20% to $85.33 Crores. That wasn’t the case the year before, when net sales fell 11% despite profits rising 75%.

The company’s liabilities are $7.9 billion for the quarter ended September 30, 2024.

prospect

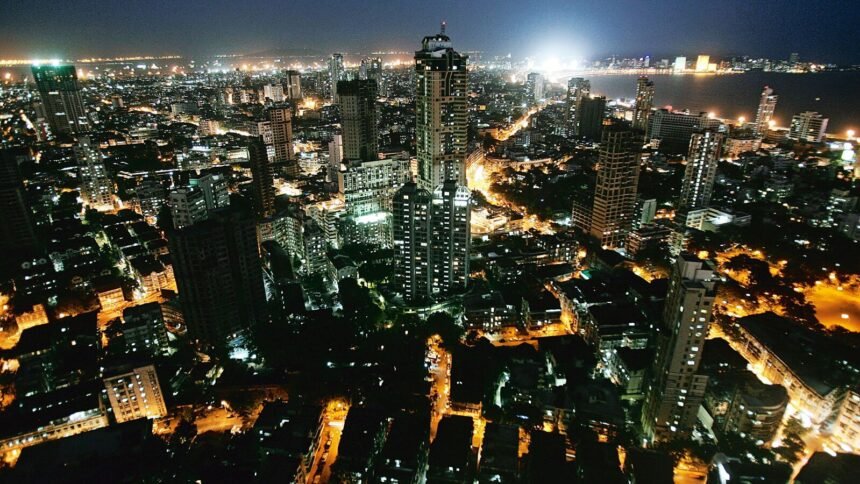

“In a city like Mumbai, having an excellent land bank is a big advantage for developers, who can also leverage their brand equity to develop the land themselves,” said Gauta, managing director and new business unit at global real estate consultancy, Mumbai. Gautam Saraf for Cushman and Wakefield.

“Also, given the growth momentum in the market and the opportunities for social redevelopment, joint ventures, joint development schemes that they have been pursuing, this could lead to inorganic growth,” Saraf added.

Mint It was reported earlier this month that developers from across the country are racing to redevelop Mumbai’s old, dilapidated buildings, housing societies and slums.

Ajmera, who is also Credai-MCHI secretary, told a press conference that more than 25,000 buildings in the Mumbai Metropolitan Region (MMR) alone have exceeded their useful life and are eligible for redevelopment.

At the same time, the cumulative half-year sales of luxury homes in Mumbai’s luxury real estate industry hit a record high, $India Sotheby’s International Realty and CRE Matrix reports show that sales in the first half of 2024 will be 123 billion rupees, an annual increase of 7.69% Mint July.

Ajmera, whose portfolio includes apartments from $5 million to $120 million, with eight projects in the pipeline in Mumbai and Bengaluru. The company intends to follow a 65:35 ratio of new projects, with the majority being residential projects and the remainder being retail and commercial mixed-use projects.

The company also has three social redevelopment projects in the pipeline, including the Bandra project in Mumbai in partnership with Rustomjee Group, the Balkrishna Society project in Versova and the Ajmera Prive project in Juhu. It has also launched a slum rehabilitation project in Bhandup district.

In 2024, Ajmera’s share price more than doubled, growing 148% to reach $1,112.15 as of December 18 $Data from the National Stock Exchange (NSE) showed that it was 448.15 on January 1, 2024. A new 52-week high $On December 17 it was 1,194.15.

The stock even outperformed Nifty Realty, which has gained 41.4% year-to-date, beating some of the top listed constituents of the index such as DLF with a gain of 20.43%, Sobha Ltd with a gain of 62.82%, Macrotech Developers Ltd with a gain of 62.82% 40.57% and Phoenix Mills Ltd’s growth of 52.16%.