With the mantra “buy high, sell high,” the appeal of momentum investing has surged, challenging traditional investing norms. However, behind this simple idea lies a complex mechanism where fund size and trading volume can greatly affect success. This is an area where careful calibration is critical, as larger funds can distort prices, while niche portfolios can better maintain the integrity of the strategy.

Volume-momentum relationship

In the niche world of momentum investing, volume plays a key role in determining the effectiveness of a strategy.

Large asset managers tend to hold large amounts of cash to take advantage of market corrections, but their vast funds face constraints. These restrictions make it challenging to invest in smaller, less liquid, and stronger securities, potentially resulting in missed opportunities.

Read this article | Meet the momentum investing champions who are beating their competition in the post-pandemic bull market

Specialized momentum strategies, especially niche PMS portfolios, deal with this problem in a different way, minimizing the market impact and maintaining the purity of the momentum signal. These portfolios are designed to maintain full market exposure and only move to cash when overall market momentum weakens significantly, such as during the Covid-19 crisis, underscoring their resilience under different conditions.

Fund size further affects momentum by affecting market dynamics. Large amounts of money entering or exiting illiquid positions can distort prices and create artificial moves that mask true momentum signals. The problem is even more pronounced among passive momentum funds, which operate within a limited universe of stocks and follow predictable rebalancing schedules, making them vulnerable to front-running.

The Evolution of Active Momentum Strategies

The development of active momentum strategies has overcome traditional limitations. By expanding the investment universe to 750 or more stocks and employing monthly rebalancing, these strategies have clear advantages. A wider universe can lead to more high-momentum opportunities and better diversification, while monthly rebalancing (unlike the semi-annual rebalancing of passive funds) allows for quicker responses to emerging trends.

And this | Master Factor Investing: Unlock Market Secrets with Value, Momentum and Quality

Recent performance highlights the merits of this approach: Valtrust’s Momentum PMS has returned 59.1% and 42.3% so far in 2023 and 2024, beating the S&P BSE 500 TRI’s 27.4% and 25.6%, respectively. Notably, this strategy achieves higher returns during bullish phases while maintaining comparable performance in flat or bearish markets.

Portfolio Construction: An Art

Building a momentum portfolio requires a careful balance. A concentrated selection of approximately 30 stocks, algorithmically ranked by momentum scores, provides optimal diversification without diluting the strategy. This approach differs from passive funds, which typically hold more stocks, which dilutes the momentum effect.

The stock selection process is rigorous, screening the top 750 stocks by market capitalization through liquidity and governance criteria before applying momentum rankings. This purely bottom-up approach focuses on price momentum and eschews subjective industry forecasts or market timing. Currently, this approach results in positions concentrated in sectors with strong momentum, such as capital goods and financial services.

the road ahead

The success of momentum investing increasingly depends on the right balance between fund size and strategy effectiveness. Consistent performance requires maintaining the purity of the strategy through careful sizing, regular rebalancing and broad equity coverage. As more investors turn to momentum opportunities, understanding these subtleties becomes critical.

ALSO READ | Let’s see who will make a comeback: quality investing vs. value investing

The rise of momentum-focused PMS products marks a major shift in the sector, providing investors with the dual advantages of professional management and the agility to capture market trends. These products combine institutional-grade analysis with the flexibility to act on emerging opportunities, providing a compelling alternative to traditional passive momentum strategies.

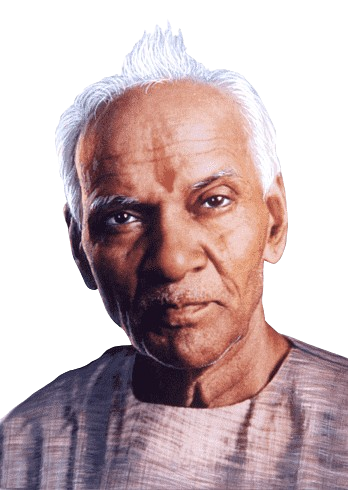

The authors are Arihant Bardia, CIO and founder of Valtrust, and Prashant Krishna, technical analyst at Valtrust.