Indian Stock Market: Domestic stock indexes Sensex and Nifty 50 are expected to remain volatile on Thursday amid mixed cues from global markets following the announcement of the 2024 US election results.

Asian stocks were lower, while U.S. stocks ended sharply higher overnight, with the Dow Jones and S&P 500 both posting their biggest one-day percentage gains since November 2022.

Republican Donald Trump became the 47th President of the United States, winning the popular vote and potentially the 270 electoral votes needed to become the next President of the United States.

Investors will now focus on the Federal Reserve’s monetary policy decision to be announced today. The central bank is widely expected to cut its benchmark interest rate by 25 basis points (bps). However, traders have begun trimming bets on a rate cut in December and the number of rate cuts expected next year, according to CME’s FedWatch tool.

Indian stock market benchmarks rose more than 1% on Wednesday, pushing market sentiment higher after former US President and Republican candidate Trump secured a decisive lead in the 2024 US election.

The Sensex rose 901.50 points, or 1.13%, to close at 80,378.13 points; the Nifty 50 index rose 270.75 points, or 1.12%, to close at 24,484.05 points.

“The favorable factors of Trump’s victory in the US election had a knock-on effect on world stock markets, including local indices, as domestic investors resorted to value buying, especially IT stocks, which pushed the benchmark Sensex index above the 80,000 mark. on. Market hopes that the new regime will not harm HIB visa rules led to a rebound in IT stocks, which have been hit hard recently. However, investors remain skeptical about the economic recovery as the FII sell-off in the domestic stock market has not abated.

Here are the key global market cues from Sensex today:

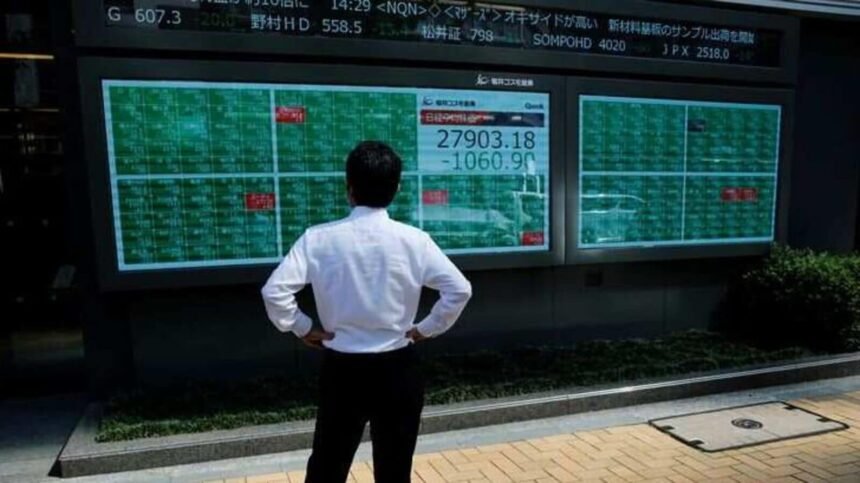

Asian market

Asian markets were mixed on Thursday after Trump won the U.S. election.

Japan’s Topix rose 0.61% and the Nikkei 225 fell 0.62%. South Korea’s Kospi fell 0.2% and the Kosdaq fell 0.78%. Hong Kong Hang Seng Index futures opened weaker.

Great gift today

Gift Nifty was trading around 24,440 points, a discount of nearly 150 points to the previous closing price of Nifty futures, indicating a poor start for the Indian stock market index.

wall street

U.S. stock indexes rose on Wednesday to close at a record high after Republican Donald Trump won the 2024 U.S. presidential election.

The Dow Jones Industrial Average rose 1,508.05 points, or 3.57%, to 43,729.93 points; the S&P 500 Index rose 146.28 points, or 2.53%, to 5,929.04 points. The Nasdaq closed up 544.29 points, or 2.95%, at 18,983.47 points.

Tesla’s stock price rose 14.5%, Nvidia’s stock price soared 4.07%, and Intel’s stock price rose 7.4%. Shares of Trump Media Technology Group rose 6%.

Dollar

The dollar hovered from four-month highs, while U.S. Treasuries fell sharply, pushing yields to multi-month highs.

According to Reuters, the U.S. dollar index, which measures the U.S. dollar against six major currencies, edged down 0.05% to 105.06, after surging to 105.44, the highest since July 3, in the previous session. The yen rose 0.22% to 154.30 against the dollar, the euro was steady at $1.0731 and the pound against the dollar stood at 1.2885.

Bitcoin surges to new all-time highs on bets on loosening cryptocurrency regulations.

U.S. Treasury yields

U.S. Treasuries fell sharply, sending yields to multi-month highs. The benchmark 10-year Treasury yield rose to 4.479%, the highest level since July.

gold price

Gold prices struggled to gain ground on Thursday as the U.S. dollar strengthened following the election of Donald Trump. Spot gold was little changed at $2,663.02 an ounce, while U.S. gold futures fell 0.2% to $2,670.40 an ounce.

oil price

Crude oil prices stabilized as traders weighed the possible impact of Donald Trump’s election and rising U.S. crude inventories.

Brent crude oil rose 0.33% to $75.17 a barrel, while U.S. West Texas Intermediate (WTI) crude futures rose 0.26% to $71.88 a barrel.

(With information from Reuters)

Disclaimer: The above views and recommendations only represent the views and recommendations of individual analysts or brokerage firms and have nothing to do with Mint. Investors are advised to consult a certified expert before making any investment decisions.

Catch all business news, market news, breaking news events and latest news updates on Live Mint. Download The Mint News app for daily market updates.

moreless